How can we know when is the best time to buy cryptocurrencies? Is it a good strategy to buy when a crash occurs? But what happens if the prices continue falling way deeper? There are many reasons why the cryptocurrency market is considered a high-risk market, due to the abrupt movements that are constantly generated, so having a strategy in order to reduce our risk is usually a very good idea.

It is true that it can be profitable to buy at a time when the market seems to be on the ground, holding the asset, waiting for upward movements to emerge and obtain extraordinary gains. However, we cannot be absolutely certain that markets will rise again to prices higher than our entry price at least in the short term, nor can we ensure that we have the best entry price. In a perfect scenario, as mentioned above, we would make huge profits. However, if something unexpected happened, our money would be stuck in a prolonged recovery period, below the entry price and without generating any profit.

The Dollar Cost Average (DCA) is an investment strategy that allows investors to minimize risk by dividing the total investment into smaller amounts, established in a regular time interval, that is, generating recurring purchases every certain time (for example, a purchase every week) without worrying about entry prices.

It is considered one of the most reliable strategies to invest over large periods of time, especially when investing in the cryptocurrency market. Investing using DCA provides us with the following advantages:

- Reduces the risk generated by high volatility by having different entry prices: Prices in the cryptocurrency market tend to move a lot, so buying all at the same price can be very risky, since it can generate a sharp drop that makes our wallet tremble.

- It reduces our investment cost: said in a simpler way, for our pocket it is easier to contribute $100 during 12 months, than $1,200 at the beginning (yes, I know not all of us have that problem).

- Potentiate our long-term results: The returns obtained using a DCA can be incredible. If you don’t believe me, try it yourself!

- It helps us avoid placing 100% of our position just before a market crash, establishing several small purchases that will take advantage of bearish movements.

- It allows us to be totally carefree, since our capital will be invested automatically as we wish. This is an exclusive benefit of our Smart DCA “The Hodler”. Enjoy your free time while our algorithms do the work for you!

- Eliminate emotions as a decision factor: an algorithm is disciplined, it is not guided by emotions and will buy according to the plan that we established from the beginning. Remember that emotions are a loss factor in the investment world. Oh, I almost forgot, this advantage is also exclusive to our SmartDCA.

Here’s an example so we can better understand how a DCA works:

Let’s go back to April 7 of this year (2021). We are planning to buy Bitcoin because it is the father of cryptocurrencies, it has a pretty good projection, and it is the crypto asset with the highest market capitalization. In addition, it has not stopped growing in recent days.

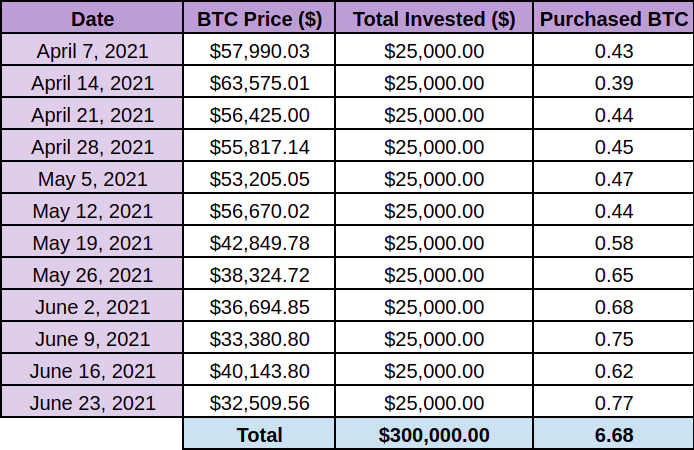

We are willing to invest a total of $300,000 in the previously mentioned asset. In this investment, we will seek to minimize the risk and we will try to get rid of different loss factors, such as emotions or wanting to anticipate the market, so we will use our Smart DCA. The DCA will be set to make weekly purchases in the amount of $25,000 during a period of 12 weeks, each one automatically. In this case, it is quite smart to use the Smart DCA, as Bitcoin is near its all-time highs and we do not want to risk a strong correction, however, we consider it to be a long-term value investment.

We will compare the results and see how profitable the use of our Smart DCA would have been versus a single purchase of $300,000 at the beginning of the period.

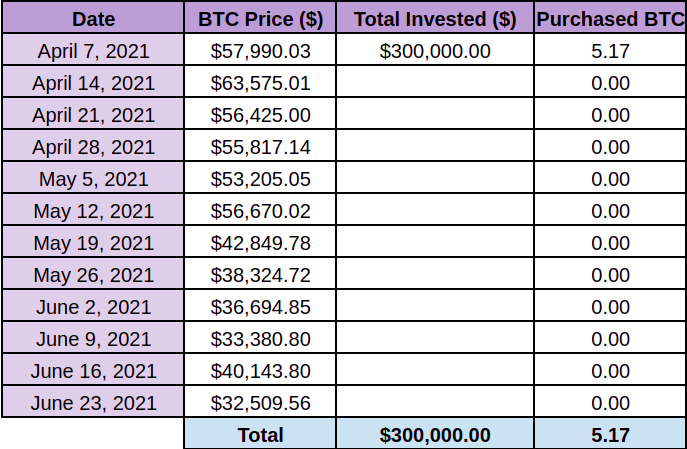

This is our first scenario, where we bought $300,000 on April 7, 2021:

This is our second scenario, where we use our Smart DCA:

This is our second scenario, where we use our Smart DCA:

As can be seen, if we had decided to invest using our Smart DCA, our total Bitcoin acquired would be higher than if we had chosen to invest all of our capital at the beginning of the established period. This happened because throughout those twelve weeks we experienced a full bear market. It is important to bear in mind that we avoided a large drop in the value of our capital, since they were bearish weeks and if we had invested the total amount in the beginning, our account would have been in negative for a while.

As can be seen, if we had decided to invest using our Smart DCA, our total Bitcoin acquired would be higher than if we had chosen to invest all of our capital at the beginning of the established period. This happened because throughout those twelve weeks we experienced a full bear market. It is important to bear in mind that we avoided a large drop in the value of our capital, since they were bearish weeks and if we had invested the total amount in the beginning, our account would have been in negative for a while.

The value of our capital in Bitcoin today (November 1, 2021), considering the current price of $61,299.81 would have been the following:

- Scenario 1: $316,920.02 (5.64%)

- Scenario 2 (DCA): $409,482.73 (36.49%)

We can see that the scenario in which we implemented our Smart DCA was much more profitable. However, it is very important to mention that making higher profits is not the main objective of the Dollar Cost Average strategy, since making a purchase at the beginning of an uptrend will always yield quite strong returns. The fact is that, as mentioned above, it is really difficult and risky to try to anticipate market movements, so in order to have a low operating cost, minimize the risk of our investment and invest SMART, our SmartDCA will always be a great option.