The cryptocurrency market has gone through a week that raises the optimism of investors, being one of the best so far this year. However, the macroeconomic situation has not been looking good so far this year, so there remains that big question whether we can really start with a longer recovery or if we are only witnessing a setback disguised as a rally.

Bitcoin, along with much of the crypto market, has had a fairly positive week, following various developments that propelled the largest market-cap cryptocurrency to break the $24,000 barrier, such as the fact that an increase is expected less aggressive rate policy by the Federal Reserve. Although inflation has been triggered and quite aggressive measures were expected from the US agency, it seems that information has been leaked about a possible softening of said measures, which have had a great weight in the behavior of high volatility assets, such as stocks and cryptocurrencies.

Tesla announced their quarterly report, which surprised us all, as they sold 75% of their reserves in Bitcoin, adding a total of 936 million dollars to their balance sheet. It should be noted that before said operation was carried out, the company had a total of 42,000 tokens, which they had acquired at an average cost of around 30,000 each.The most surprising thing is without a doubt that the company liquidated its crypto assets with a huge loss, since at the end of the second quarter of this year the largest and most important cryptocurrency in the world was trading close to $20,000, so they would have liquidated their operations losing close to $10,000 for each unit. Could this be an alarming indicator of the short-term future in the cryptocurrency market? There is no doubt that a company as large as Tesla can generate a high level of uncertainty among investors.

It has been a very tough year for the financial markets, and the fact is that the high levels of inflation have led the financial organizations of different countries to make strong changes in their monetary policies, having a significant impact on high volatility assets. A very important day has come to give us an idea of what awaits us in the short term, and that is that the European Central Bank announced that it will increase its interest rates by 50 basis points, this being the first in 11 years, and the highest since that in the year 2000.This has resulted in a recovery in the euro, as the currency had fallen significantly to lose its parity with the US dollar. However, Christian Lagarde, president of the European Central Bank, mentioned that the main objective will be to lower the inflation rate by 2%.

It seems that this week has filled large investors with optimism, leaving aside what has happened with Tesla. Massive purchases have begun, which usually occur at the beginning of a bull market, and now the Galaxy Institucional Ethereum Fund has bought about 75.6 million dollars in Ethereum, according to a report by the United States Securities Market Commission. States (SEC).Said purchase has been carried out among a total of 21 investors, and each one has contributed a minimum of 100,000 dollars. It should be noted that said investment was carried out directly in Ethereum tokens available in the open market, not in a secondary or underlying market, so it could have significantly affected the price of the asset.In addition, it is important to mention that it is rumored that Goldman Sachs could have been part of that group of investors that carried out the operation, since they began offering the Galaxy Ethereum fund a couple of months ago.

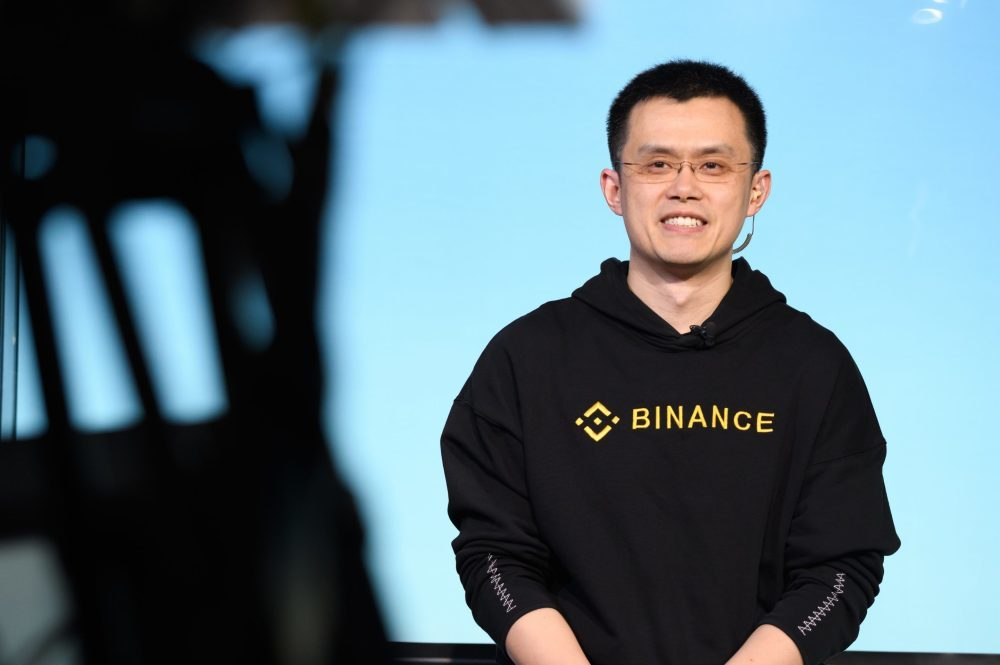

In other news, Binance has established itself as the exchange with the largest amount of Bitcoin (BTC) on its platform, surpassing CoinBase. This demonstrates how crypto investors see Binance as the safest and most favorable exchange to trade their crypto assets. Binance currently has a cryptocurrency trading volume of close to $20 billion. It seems that Binance is gaining quite a bit of strength, and is getting closer to establishing itself as the absolute giant in the world of cryptocurrency exchanges.

The concern and uncertainty continues for Celsius users, and that is that the outlook does not look good at all, since the probability that they will recover their funds in the short term is practically nil. After the company declared bankruptcy, a very complicated legal process began, which could take years to reach a solution.The company reported a $1.2 billion deficit on its balance sheet a couple of weeks ago, and currently has more than 100,000 creditors.

Bitcoin starts the week in red, trading near $21,800, after a bullish week that reached a very interesting support zone. This week we could see a pullback again to $19,000, which pretty much wiped out the gains seen the week before. On the other hand, should it manage to break the $23,300 resistance, we could see a move higher to $28,000. However, it seems that this level has been well respected, so such an upward movement does not look very likely in the short term.

For its part, Ethereum is above $1,500, falling about 5% today. Should a bearish move in the market continue, we could see Ethereum close to $1,200. However, ETH has not reached its most relevant support zone, near $1,770.

We have witnessed a rather optimistic week. However, the macroeconomic situation is far from optimal, so to say that we are at the beginning of a bull market would be somewhat irresponsible. However, we can see that the optimism in the cryptocurrency market by many investors is still present, and it is essential to think in the long term when making purchases in this type of asset, given its high volatility and the moment for which that we are currently going through. Without further ado, we wish you an amazing week.