The cryptocurrency market continues to behave sideways after a slight recovery, with a large number of investors expecting what will happen in the short term, after a new interest rate hike was revealed in the United States by the Federal Reserve.

Inflation has been one of the main enemies for the Federal Reserve so far this year, as it has reached historical figures that we did not see more than 40 years ago. That is why the decision has been made to make the fourth increase in interest rates so far this year, replicating the adjustment that took place in June, with an increase of 0.75%.

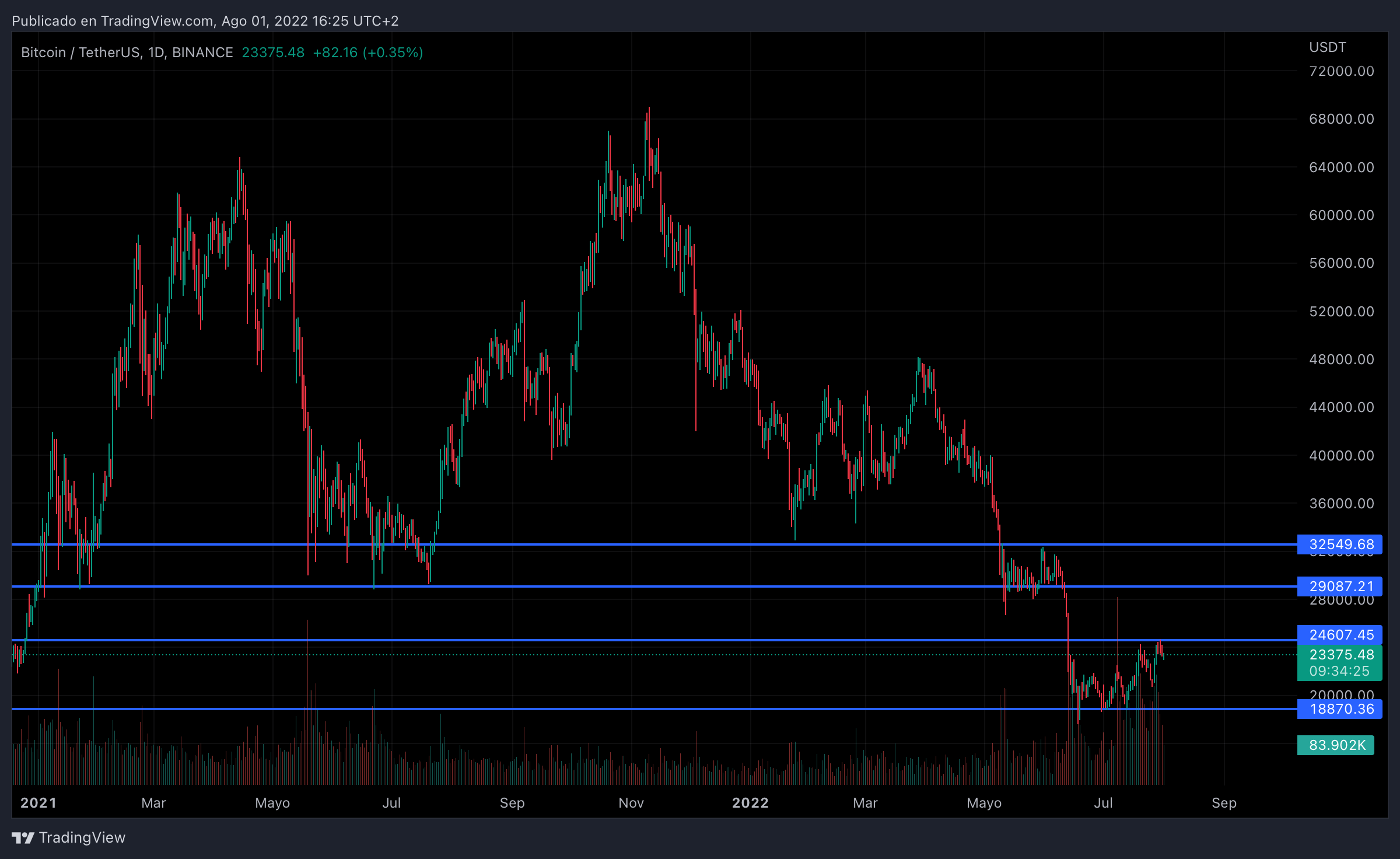

While this is usually not good news for high volatility assets, including cryptocurrencies, some assets like Bitcoin reacted positively by holding steady above $20,000 and reaching as high as $24,000 as the surge was as expected. a large number of analysts, who cataloged said increase as a sign of flexibility on the part of the Federal Reserve. With this, interest rates reached a range between 2.25% and 2.50%.

It has been a year of considerable speculation regarding the economic situation and the outlook, especially in the short term, after several months with falling financial markets, rampant inflation and a monetary policy totally focused on combating it. However, the president of the United States of America, Joe Biden, was quite optimistic last Thursday when presenting various data about the contractions in the US economy, since he highlighted several positive facts, such as the high interest rates of contraction, the best level of unemployment in more than 50 years and the investments of the industries.

Having said this, he ended his speech with a phrase that generated a lot of optimism in some investors and North American citizens, since he assured that this does not seem to him to be a recession. The public’s approval rating for the president has fallen to a historical low of 36%, with great concern regarding the economic situation of the United States, at least in the short term.

In other news, the International Monetary Fund (IMF), through a report on the economic outlook, has indicated that the fall in the cryptocurrency market this year has not generated any direct impact on the traditional financial system. However, they are aware that stricter financial conditions should be created for emerging markets to protect users, after what happened a couple of months ago with Terra. However, a study was carried out by the institution, which estimated an inflation of 12% for 2023. Scary!

Bitso and São Paulo FC, one of the most popular Brazilian teams in the country, collaborated to carry out the hiring of Argentine soccer player Giuliano Galoppo, from Club Atlético Banfield. Said contracting will be carried out using the stablecoin USDC, through the Bitso platform, with a transaction amount of around 6 million dollars. Here we can see that more and more sectors and companies are beginning to venture into paying through cryptocurrencies in their day-to-day activities.

Bitcoin is currently above $23,300, close to a quite interesting resistance level, as it marks that literalness that has been generated in recent weeks. If it cannot be breached, we could see a drop below $21,000.

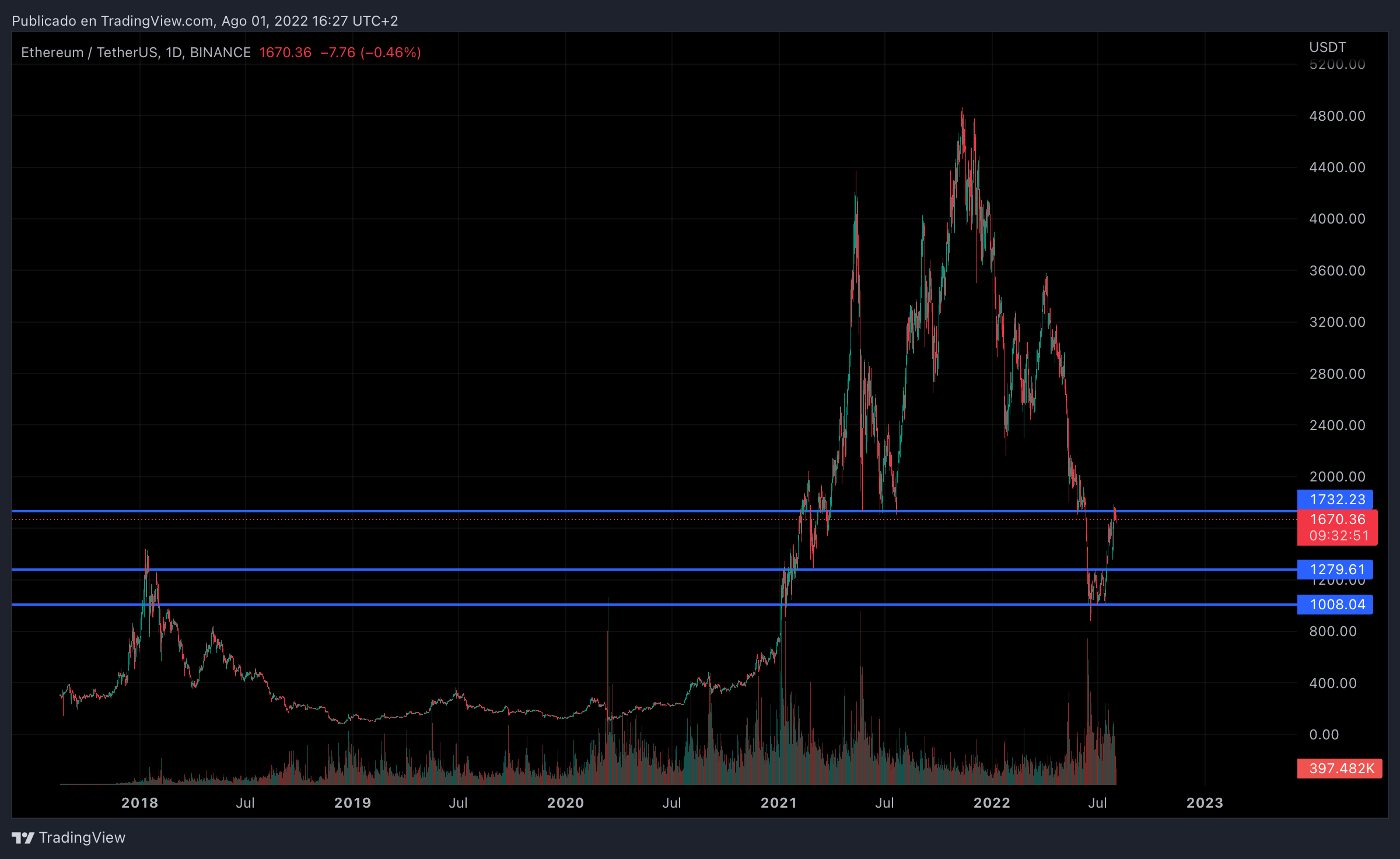

For its part, Ethereum is trading above $1,680, with quite a lot of upward force, near a very interesting zone. There is no doubt that ETH looks more bullish than Bitcoin itself, but if both assets fall, Ethereum could return to below $1,400.

There is no doubt that the economic outlook does not look good for this second half of 2022, however, the implementations of cryptocurrencies in different sectors of daily life and global markets show the great potential of crypto assets in the long term. Without further ado, I wish you an amazing week.